?

In this community resource guide, I will answer the question of ?

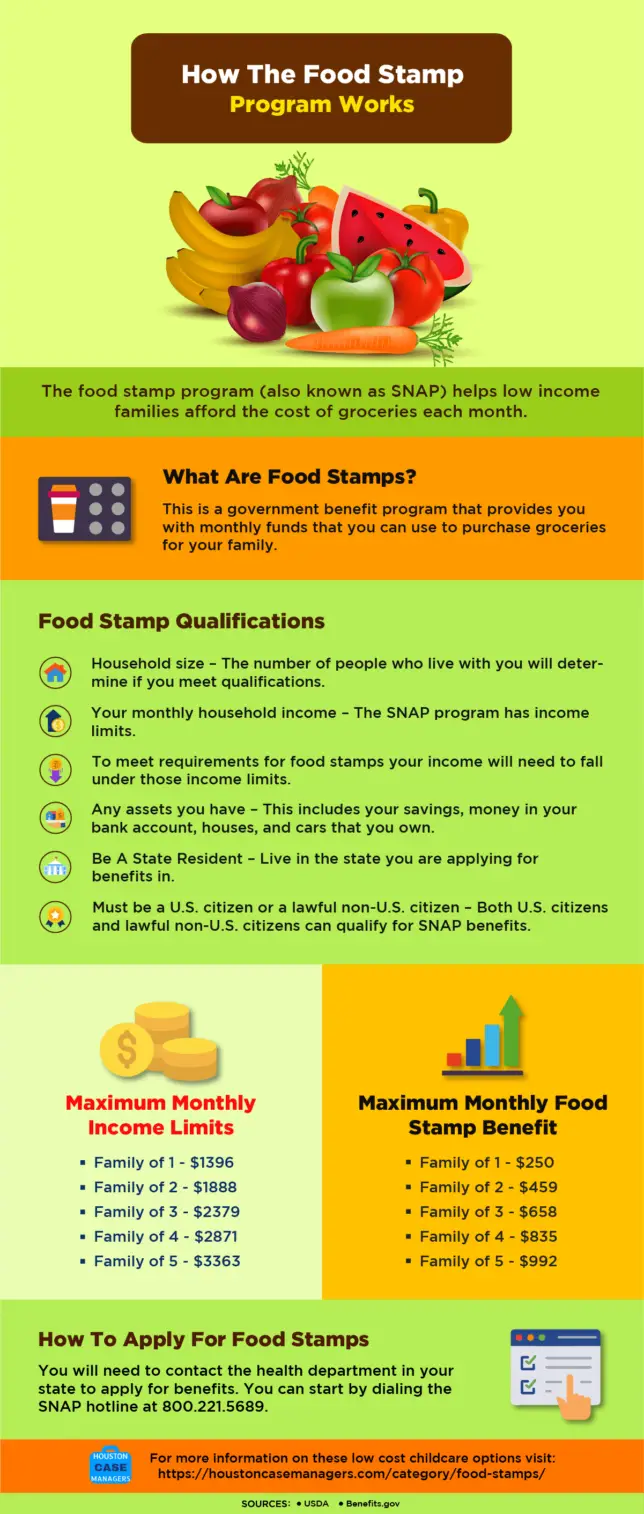

In order to qualify your must fall below a certain level. The program uses metrics like gross and to determine whether or not you qualify for .

If you’ve never applied for SNAP benefits but are unsure if food stamps consider your on a gross or net basis, this article will explain how things work. Continue reading and we will break down which measurement is used to determine if you qualify for food stamps.

Is SNAP Based On Gross Or ?

The determines by using both your gross and . In order to qualify for SNAP benefits, your monthly gross and will need to fall under the limits.

Next, we’ll define and to give you a better idea of how SNAP determines based on your .

What Is ?

is the total amount of money that you earn, before any taxes or other deductions are taken out of your check.

What Is ?

The amount of money remaining in your check after taxes, health insurance, and other deductions are subtracted is called .

The SNAP program calculates by looking at your and then subtracting any deductions you have. The amount that is left over is your .

When applying for food stamps its important to list every that you have. These deductions demonstrate to SNAP that, while your is fixed, you truly have only a limited amount of money to buy food after you’ve paid all of your bills.

Deductions: Why It’s Important To List Every You Have On A SNAP Application

deductions are costs that you can subtract from your monthly . The more deductions that you have the lower your will be.

Examples of expenses that you can deduct on a application include:

| Deduction | Description |

| Monthly Bills | These monthly bills can potentially be deducted from your : rent, mortgage, water bills, gas bills, utility bills, your phone bill, home insurance, taxes on your home. |

| Dependent Care Costs | The will allow you to deduct things like childcare costs, money spent caring for people in your with disabilities. This also includes senior citizen expenses. |

| Employment/Training Costs | If you are paying tuition or for training programs, this is another cost that you can deduct on the application. |

| The Care Of A Child Outside Your Home | These deductions are things like payments, medical bills, and health insurance that you pay for a child living with an ex-spouse of yours. |

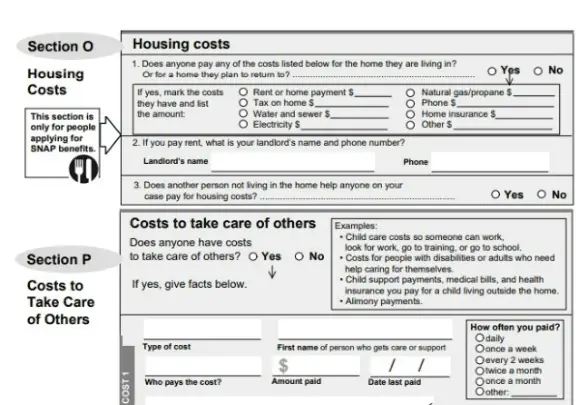

Remember if you are applying for SNAP benefits and pay any of these bills be sure to list them on your application. The section that you will make these deductions will depend on your state. If you are in Texas, you can list these deductions in Section O of the application.

How Does The Determine ?

SNAP will take your and subtract your deductions to get your .

The has requirements for both gross and . Here are a few scenarios to help you understand how the determines whether or not you qualify for food stamps.

| Scenario | Description |

| High Gross Income | If your exceeds the for the SNAP program you will not qualify for the . |

| Low | If your falls under the limits, you will now have to meet limits. To meet limits it’s important to list as many deductions as you have. |

| High | If you met limits but failed to meet limits, take a look at your deductions. Have you listed all of your deductions? If not list those deductions to see if this lowers your |

| Low | If your falls under the limits, then you should qualify for food stamps. |

In addition to meeting the and requirements, you will also have to pass an asset test.

In Texas, your assets must be no more than $5000. Assets that the consider are second homes, a car over $15,000 in value, and a second card over $4,650.

How To Find The Gross And Limits For Food Stamps?

To learn more about gross and limits, you will need to contact your state’s health and department. Each state has different guidelines.

Editor’s Note: If you are in Texas you can use this link to see the monthly income limits for Texas food stamps.

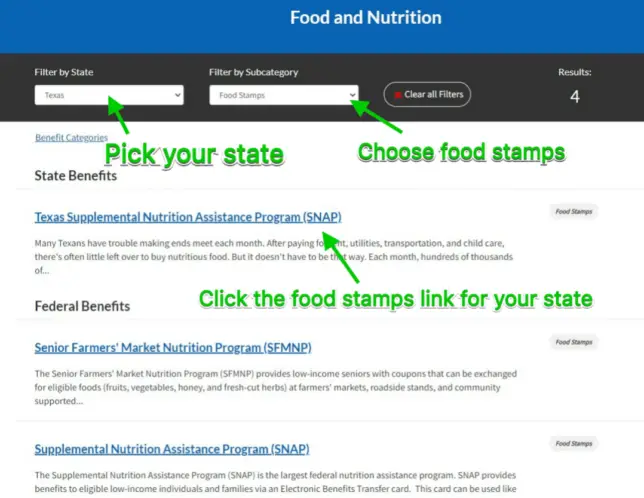

One website that makes it easy to find your state’s and learn about gross and limits is called Benefits.gov.

Use the link above to visit the Benefits.gov website and:

- Choose your state.

- Pick food stamps as the subcategory.

- Click your state’s link.

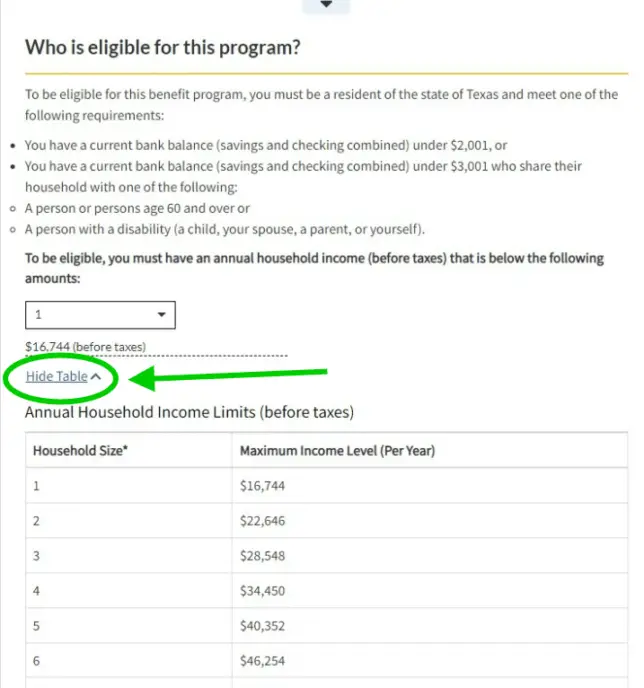

From there you will be taken to a page that will tell you more about your state’s . Scroll down to the “Who Is Eligible For This Program” section and find the “view/hide table” link and click it. You will be shown a table that shows limits for the in your state.

Conclusion

The determines your based on your monthly gross and .

First, you must meet the . This is your before taxes are taken out.

Next, you’ll need to meet limits. You can lower your by listing deductions on your application. The lower your the better your chance of qualifying for the SNAP program in your state. Because of this, it’s important to list every you have. Costs like housing, medical care, and expenses can be deducted from your to make your lower.

If you have more questions about gross or limits for SNAP benefits, contact your state’s department. You can find your department by using this link and visiting Benefits.gov.

Similar Articles That May Interest You:

- What Is The Texas Food Stamp Monthly Income Limit?

- How To Apply For Emergency Food Stamps In Texas

- 7 Weird Things You Can Buy With Food Stamps

- I Didn’t Receive Food Stamps This Month. Now What Do I Do?

- How To Use The Texas Food Stamp Calculator To Determine How Much Food Stamp Benefits You Will Receive Each Month

Nick Bryant is the author of Understanding Healthcare Is Half The Battle and a Senior Counselor with 13+ years of experience working in community health and mental health. He enjoys spending time with his family, watching WWE on Friday nights, and working toward a Google Data Analytics certification. If you have additional questions about community resources or government assistance programs, simply leave a comment below and he will follow up as soon as possible.